On May 31, 2023, the Treasury Department and IRS released a second round of proposed rules for the IRA’s bonus tax credits. The new notice invites stakeholder comments through June 30th. After the comment period, the agencies will issue a comprehensive set of program rules for the remainder of the 2023 tax year. Our team has summarized the new proposal below.

Table of Contents

MAY GUIDANCE: WHAT CHANGED AND WHAT CAN WE EXPECT?

When can we apply and when should we expect awards?

Treasury and the IRS are still on track to release final rules for the 2023 allocation year by this fall. The Department of Energy plans to open the application portal and begin allocating awards before the end of the year. An optimistic outlook: rules are issued in August; the application window opens for September and October; first round of awards is announced in December.

Previous guidance indicated that the bonus credit categories would open at different times, but Treasury has now proposed that the initial window open for all four categories at once. If any category doesn’t receive enough applications to fill the allotted capacity for this program year, there will be a rolling application process that follows the close of the window.

How will awards be decided?

All project applications that are submitted during the initial window will be evaluated at the same time. The full set of criteria is still to be determined, but Treasury introduced a new element in the latest proposal which would prioritize all projects that meet at least one of two “Additional Selection Criteria” buckets below.

- Ownership criteria: Owned by a tribal enterprise or Alaska Native Corp, consumer or worker cooperative, certain “qualified renewable energy companies,” tax-exempt entities

- Geographic criteria: Located in a Persistent Poverty County or in a Climate & Economic Justice Screening Tool: census tracts designated as disadvantaged based on 90th percentile energy burden or PM2.5 exposure + 65th percentile low-income

More specifically, May guidance proposed that 50% of the total capacity for each category be reserved for these projects, and additional priority be given to applications that meet both. Even beyond the 50% carveout, all projects that meet these criteria would be favored over those that do not.

Treasury again mentioned that a lottery system may be used in the case of oversubscribed categories and reiterated that projects already placed in service will not be eligible for award.

What will we need for the application?

The guidance includes proposed application requirements for both behind-the-meter and front-of-the-meter projects across all four bonus credit categories. The proposed requirements for category four, front-of-the-meter projects (where most community solar projects will fall) include the following:

- Documentation of interconnection agreement

- Attestation to:

- Site control

- Secured permits

- Appropriately sized allocations

- Inspected installation sites

- Delivery of disclosure forms to customers

Did anything about the capacity categories change?

Yes, and there’s both good and bad news for community solar. The bad news: for category one (located in a low-income community), the 700MW will reserve 560MW for BTM projects. The good news: category four (low-income economic benefit projects) is now limited to projects serving multiple households, which is a clear emphasis on community solar.

Did Treasury define financial benefits for community solar projects?

Yes, in addition to the new emphasis on community solar for category four, Treasury explained how to meet the financial benefit requirements: (1) deliver 50% of the project output to qualifying low-income customers, and (2) deliver that portion with at least a 20% discount rate on the bill credits.

Have income verification methods been established?

Some have been, but more clarity is needed. The latest proposal confirmed that proof of participation in needs-based programs at the federal, state, tribal, and utility levels will be accepted. Treasury added that state agencies and community solar program administrators can provide verification if the state program’s income limits are at or below the federal threshold (200% FPL or 80% AMI). Despite deferring to state agencies, the proposal also stated that self-attestation will not be an available method. More details later this year are needed to confirm the full slate of options.

What do we know about ongoing compliance?

Treasury has a five-year window to recapture the bonus credit if the awarded project fails to deliver the commitments outlined in its application.

What is the community solar industry still waiting for?

- Full application evaluation criteria and review process

- Timing of application window

- Full list of verification methods for qualified recipients

- Eligibility of master-metered affordable housing

- Details on compliance and ongoing reporting

Not only is there still much to be determined, but all of the existing guidance is subject to change over the coming months. Once the stakeholder feedback period closes at the end of June, and we have more to share, our team will be back here with the latest details.

May 7th, 2023

The following content is original perspective on the Investment Tax Credit from May 7th, 2023.

Recently the Treasury Department released a highly-anticipated first round of guidance on the Inflation Reduction Act’s new tax incentives for solar projects serving low-income communities. Our team, dedicated to delivering the benefits of clean energy to LMI communities and ensuring our development partners realize revenue, dug into the document and broke down our findings below.

The consensus – from those of us eager to see development of eligible projects move along — is that the guidance keeps us waiting; it’s sparse on eligibility details and suggests that community solar projects energizing in 2023 will face a tight timeline to qualify for the economic benefit project category, which developers have been modeling for since the Inflation Reduction Act (IRA) passed in August.

Nevertheless, this is a step in the right direction – and as we get closer to bringing eligible farms online, Solstice is as well-positioned as ever to partner with developers and manage projects that are committed to bonus credit eligibility.

Solstice is already managing roughly half of the approved capacity in Illinois Solar for All, one of the country’s leading low-income community solar programs. We’ve also managed low-income projects in Massachusetts, New Jersey, and New York, with more on the horizon. Years of experience in these programs and our mission founded in grassroots organizing means our teams at Solstice are particularly familiar with the low-income program requirements and qualifications informing Treasury’s program design. Solstice currently enrolls customers based on any of the potential LMI qualification methodologies that Treasury may require and has a streamlined, customer-focused experience that enables all users, in multiple languages, to easily enroll in projects that they qualify for. Our bilingual Outreach and Customer Success team ensures a smooth customer experience from start to finish. If you’re interested in learning more about our subscriber acquisition and management experience and offerings, schedule a call with our team.

Now, onto what we do and don’t know about these tax incentives.

WHAT’S NEW ON LOW-INCOME TAX CREDITS IN THE GUIDANCE

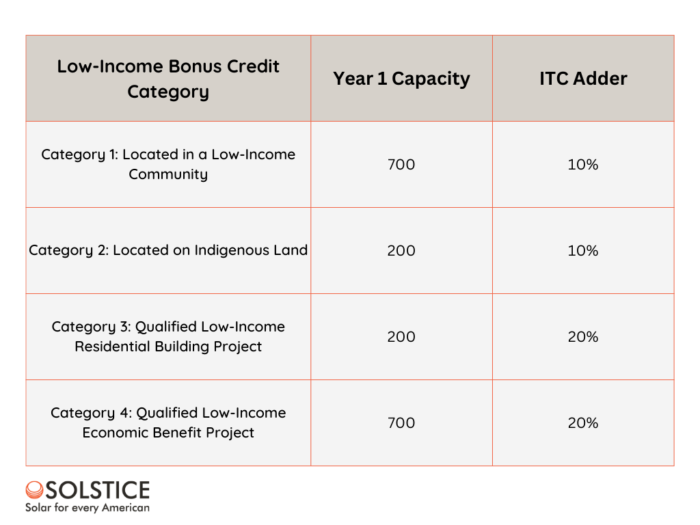

- Allocation: Breakdown (below) of the first 1.8 GW across four low-income bonus credit categories

- Application: Applications across categories will open in phases, offering 60-day windows

- Timeline: The order of categories: 3 and 4 in Q3 2023; then 1 and 2 to follow

- Admin: DOE will review applications and lead allocation processes

- Eligibility: Projects that energize before being awarded an allocation will not receive the credit

NEXT ROUND OF GUIDANCE: WHAT TO LOOK FOR

The first round of guidance mentions forthcoming guidance and additional criteria 10 times throughout the 10-page document. What exactly does a project need to have/commit to for qualification in each category? How and what should be prepared ahead of the application windows? For now, we’re still waiting for the answers that developers and asset owners need to update project plans and models.

All Categories

- How applications will be scored and awarded

- What will be required for eligible applications

Categories 1 & 2

- Site control

- Interconnection agreements

- Completed utilities studies

- State and local permits

- Letters of support (category 2)

Categories 3 & 4

- How to define and assess the financial benefits that must be provided

- Acceptable income verification methods

- Potentially ranging from self-attestation and geo-eligibility to proof of income or participation in income-based assistance programs

- Required plans to distribute benefits equitably

- Required list of eligible beneficiaries and capacity allocation

- Reporting requirements

- Required building verification (category 3)

- Required statements from residents agreeing to distribution of benefits (category 3)

The only new information relevant to improving your application is that the following items may boost your chances of being awarded capacity:

- Ownership or development by community-based organizations and mission-driven entities

- Intent to include new market participants

- Above-and-beyond bill savings for low-income communities and marginalized individuals

- High degree of commercial readiness

The timeline for forthcoming guidance is up in the air but leading trade groups and industry stakeholders have already requested meetings with Treasury and are pushing for more guidance ASAP. Solstice will continue to stay engaged on advocacy to the White House, Treasury Department, IRS, and DOE.

INDUSTRY REACTION

Beyond the overall feeling that this round of guidance largely kicks the can down the road and was only issued this early in order to comply with the IRA’s legislative requirements, there are a couple other pieces of commentary worth mentioning.

As explained above, the four categories of capacity are broken down by bonus credit type, instead of project sector (e.g. community solar / residential projects / multi-family residential / etc.), which would likely make application reviews more efficient and consistent. The proposed breakdown will pit projects with significantly different structures — both in development cycles and delivery of benefits — against each other for capacity. As of now, community solar projects could fit into any of these categories, but we’ll be on the lookout for upcoming eligibility criteria that could change that.

The guidance suggests that a lottery may be used when there’s an excess of eligible applicants by category, but it leaves room for DOE to decide on other processes instead.

Interested in working with Solstice? Schedule a call to meet with our business development team at bd@solstice.us.

WHAT WE ALREADY KNEW

As we wait for additional details, let’s recap what we already know about how the IRA is affecting the landscape for community solar development.

INVESTMENT TAX CREDIT BASICS

- Interconnection costs now included for projects up to 5 MW (ac)

- 30% base ITC requires pending prevailing wage and apprenticeship requirements be met for projects ≥ 1 MW

- Without meeting prevailing wage and apprenticeship requirements, which apply during construction and 5 years after (for alteration and repair), base ITC drops to 6%

- There are two other 10% bonus credits, which can both stack together on top of one of the four low-income bonus categories

- Domestic content: 100% of steel and iron or a required percentage of total manufactured components sourced from the U.S.

- Energy community: brownfield site, former fossil fuel extraction site, or retired coal mine site

- Project owners can apply for and receive one of the four low-income bonus credits in addition to the 30% base, the 10% domestic content, and the 10% energy community

- Applicants have four years from the date of low-income bonus credit award to place the project in service

- Eligible projects for bonus credits must have a net output of less than 5 MW (ac)

Need help with customer acquisition?

Our partnership-driven acquisition strategy ensures every community sees the positive impacts of your renewable energy projects.

LOW-INCOME BONUS CREDIT BASICS

- The low-income bonus credits include four separate project categories, which share 1.8 GW (dc) of annual capacity for each of the 2023 and 2024 round

- Eligible projects can each only be considered for one categor

- Project size cap is 5 MW (ac)

- (1) Located in a Low-Income Community

- As defined here in section e: 45d(e) Low-Income Community

- (2) Located on Indigenous Land

- As defined here: 25 USC 3501(2) Indian Land

- (3) Qualified Low-Income Residential Building Project

- Installed on a residential rental building which participates in a covered housing program: (1) under the Violence Against Women Act; (2) administered by the Department of Agriculture; (3) administered by a tribally designated housing entity; (4) other affordable housing programs determined during the rulemaking

- The financial benefits of the electricity produced by such facility must be allocated equitably among the occupants

- 4) Qualified Low-Income Economic Benefit Project

- At least 50% of the financial benefits of the electricity produced must be provided to households with an income of less than 200% of the federal poverty line or less than 80% of the area median income, where financial benefits is thus far defined to include — at a minimum — “electricity acquired at a below-market rate”

- (1) Located in a Low-Income Community

BEYOND THE INVESTMENT TAX CREDIT: $7B FOR STATE DG PROGRAMS

IN THE GHG EMISSIONS REDUCTION FUND

The IRA earmarked $27 billion for technology-neutral funding from the EPA. Within that pie, there’s a $7 billion slice available to states — on a competitive basis — for distributed generation programs. EPA issued the initial program details along with Treasury’s ITC guidance last week. Below are highlights from what we know thus far:

- Funds are available to states on a competitive basis

- Awards will be for both expanding existing DG programs and creating new ones

- Only about 60 awards are expected, for at least $100 million each

- States with robust existing DG programs are best positioned to win awards

- Solicitation for bids will begin early this summer, with all $7B to be dispersed in 2024

The implication for community solar is that some of these awards could be used to expand existing programs and fund the creation of programs already under development. Much like on the ITC bonus credits, Solstice plans to remain engaged as industry stakeholders meet with EPA to inform the upcoming detailed program design.

NEXT STEPS

Solstice will publish a follow-up piece when there’s more to share on the ITC guidance. Until then, please feel free to schedule a call with our business development team to learn more about Solstice’s services and discuss how we can work together to best prepare for any and all of the above.