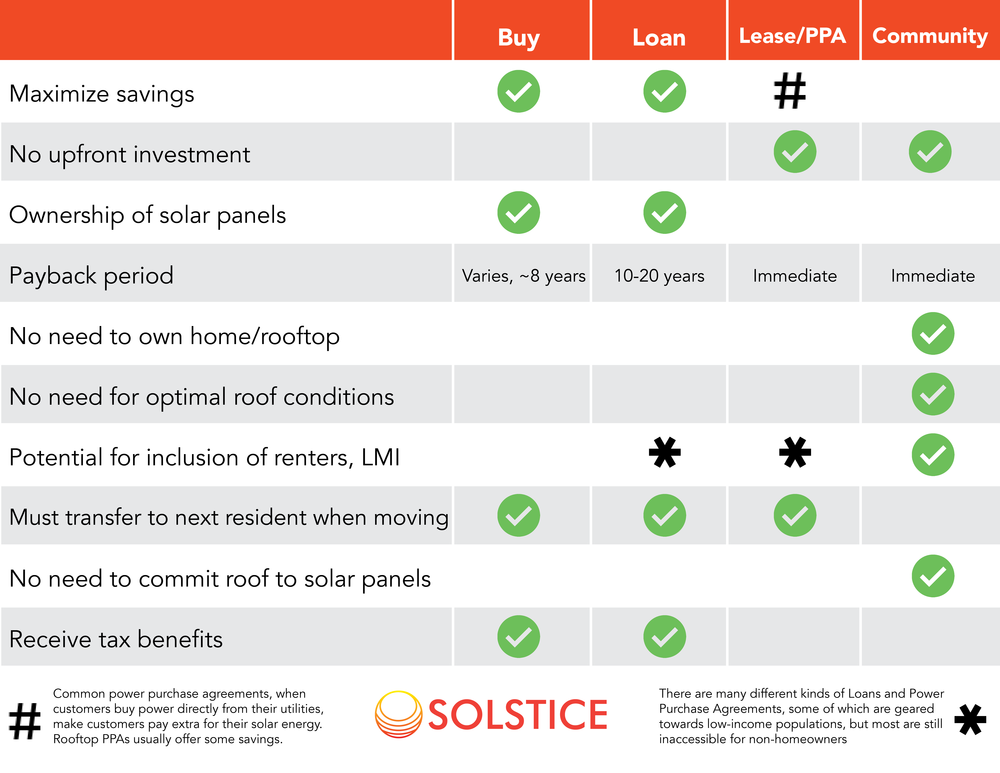

Solar is booming in America, and there are many options for getting access to your own solar power, so it can be difficult to know which option is best for you. Today, we’re going to lay out the most common solar options and help you understand their benefits and drawbacks.

The first thing to consider when you’re thinking about going solar is, can I (and do I want to) put solar panels on my own roof? If your home is in the 20 percent of American rooftops that is structurally sound, shade-free, and faces south or west, you’ll probably see the biggest financial benefit from installing solar panels on your home. There are a few different options to get panels on your roof:

Table of Contents

Solar Option 1. Buy Your Solar Panels Outright

If you really want to maximize your savings and you can afford the upfront expenditure (an average cost of $10,000-$15,000 before tax credits), your best option is to pay for your panels outright. You’ll need to find an installer you trust and pay for the panels, equipment and installation costs, but once they hook your system up to the grid, you should start seeing savings on your energy bill, you’ll enjoy the tax benefits associated with ownership, and your upfront investment typically will pay off in 4-8 years.

Solar Option 2. Finance Your Solar Panels With A Loan

Most banks will allow you to finance a solar system through a home equity loan, which uses your house as collateral. Low interest rates and tax deductions make this the most cost-effective option, but institutions like Sungage and Solar Mosaic offer solar loans, which are financed based on your future savings. You’ll typically pay nothing upfront and pay a monthly cost until you pay back your loan (normally 10-20 years). At the end, you own the panels and the associated tax benefits.

Solar Option 3. Lease Your Solar Panels

Many major solar installers let you lease your solar panels. This option allows you to go solar without any upfront cost, paying a monthly fee and seeing savings on your energy bill. Contracts last for the normal life of the solar panel (~20 years), and at the end, most contracts will give you the option extend your lease or to pay down the system and own it outright. This option is nice in that you aren’t taking on debt, but be careful–if you do hope to own your system eventually, a leasing plan can significantly reduce your savings.

Solar Option 4. Buy Your Solar Power Via A Power Purchase Agreement

In practice, power purchase agreements (PPAs) are very similar to solar leases. There is no upfront fee, but instead of paying a monthly fee for the panels and seeing savings on your energy bill, you’re locking in an electricity rate for a period of 20 years, that is projected–but not guaranteed–to be lower than utility rates. You do not own the panels, and you won’t see the tax benefits directly–those go to the company who financed and installed the system. You’ll generally see some savings on your bill, but they’ll be even less than with a lease.

If you aren’t able to install panels on your own roof, you’re not alone: the National Renewable Energy Laboratory (NREL) estimates that nearly four in five Americans can’t install solar on their rooftop. But in 36 states and the District of Columbia, there is now an option for these households.

Solar Option 5. Enroll in a Local Solar Farm

Known as community solar, this option lets anyone sign up for an allocation of panels in a nearby solar farm and see savings on their energy bill. Since there is no need to install anything on your home, this is the most universal option, allowing you to go solar regardless of your rooftop or ability to pay the upfront hardware costs.

Got it? Information overload? Here’s a handy chart comparing your options: