Most solar developers mandate that their customers possess a FICO credit score of 650-700+, which prevents over half the country from participating in community solar. Solstice set out to find a better, more inclusive qualification standard.

American solar energy is at a crossroads. Even as tariffs continue to limit the industry’s growth and job creation, new innovations are making solar energy more accessible than ever and preparing the market for an unprecedented expansion of clean energy.

One of these innovations is Solstice’s new community solar qualification metric, the EnergyScore. Leveraging data from nearly 875,000 customer records, the EnergyScore is projected to predict future payment behavior more accurately than FICO credit scores, while simultaneously including a larger proportion of qualified low-to-moderate income customers.

Table of Contents

A Slanted Solar Landscape

Today, approximately four out of every five American households can’t get rooftop solar. The reasons for their exclusion vary, from the eligibility of the individual rooftop, to homeownership status, to one’s access to financing. Nevertheless, these factors create a clear division along lines of socioeconomic class: while 40 percent of American households earn less than $40,000 per year, they make up less than 5 percent of solar installations.

Community Solar: A More Equitable Model for Solar Energy

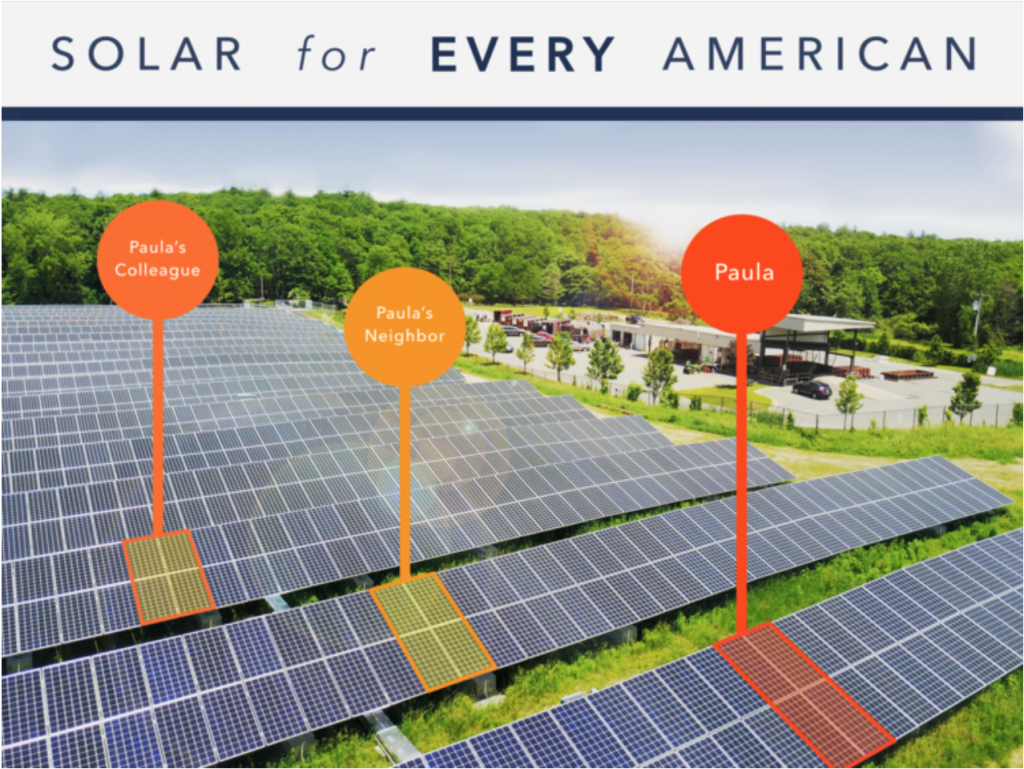

Solstice was founded on the conviction that community solar could help build a more equitable energy system. This innovative model, now established in 14 states and Washington, D.C., allows households to subscribe to a local solar farm and see savings on their electric bill.

A Scalable Model for Solar Inclusion

Solstice conceived the EnergyScore as a scalable way to increase the inclusivity of community solar farms. Leveraging utility payment history and other customer data, the EnergyScore aims to provide solar developers with a metric that is more accurate and inclusive than FICO credit scores in predicting the rates at which subscribers default on their bill. If it fulfills these goals, solar developers will be motivated to adopt the EnergyScore because it expands their customer pool and lowers customer turnover rates—and more importantly, a higher proportion of LMI individuals will be qualified to save with community solar. It’s a win-win. Read our white paper for full details here.

Early results are positive: after analyzing nearly 875,000 customer records, Solstice and its partners at MIT and Stanford have produced a final version of the EnergyScore. Customer data suggest that it represents a 40% accuracy improvement over FICO in predicting utility bill payment behaviors and is 10% more inclusive of LMI households. Solstice is currently seeking partners to carry out low-income focused pilot projects to test and refine the metric.